Please see the full disclaimer located at the bottom of the blog post.

Most of us have a thought on retirement plan in our late twenty or late thirty, but it is just a rough idea in our mind. When we are working hard on our businesses or our investments, have a crystal clear idea of the financial outcome we want to achieve is crucial to reach the destination we aimed for. Do you know how much money do you need to retire comfortably?

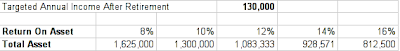

In my opinion, a good retirement plan shall target for annual income equals to 13 times of the last drawn salary prior to retirement. Why 13 times? It is equivalent to your 12 months basic salary plus 1 month bonus, don't you want to have bonus even after you retired? Let's say in our hypothetical example, the last drawn salary is $10,000, targeted annual income after retirement is $130,000.

Why $10,000? I think $10,000 is the minimum monthly income you need to have your retirement comfortably. Let's do the math.

Given input for Today's Amount is $3,000, Annual Inflation Rate is 6% (conservative measure), Number of Years is 20. The first result (Reduced Amount) is $935.41, which represents the value of $3,000 in 20 years. The second result (Required Amount) is $9,621.41, which is amount of money that you need in 20 years to match the purchasing power of $3,000.

How do you still making $130,000 annually when you are retired? It is not a top secret, just start accumulating assets that produce recurring passive income such as rental income, dividend income, interest income, business income, etc.

Table above is that rate of return and total asset required to achieve annual income $130,000. In this case, if your accumulated assets produce 12% return annually, your total asset value must at least worth $1.083 million. So, $1 million is a good number to start to establish your asset portfolio. Warren Buffett had written a great section regarding asset classes available for investors, please see The Basic Choices for Investors and the One We Strongly Prefer (A text that I extracted from 2011 Berkshire Hathaway Shareholder Letter).

Lastly, you may have higher or lower requirement for targeted annual income after retirement which different from $130,000, please do your own math using Inflation Calculator and Retirement Fund Calculator.

I'd love to hear your comments!

Saturday, March 3, 2012

How Much Money Do You Need to Retire Comfortably?

Subscribe to:

Post Comments (Atom)

Disclaimer

The author writing this blog is for personal records and information sharing purpose only, it is not professional investment advices. The author specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. Neither the author shall be liable for any loss of profit or any commercial damages, including but not limited to special, incidental, consequential, or other damages.

No comments:

Post a Comment