United Malayan Land Berhad's (hereafter called "UMLAND") principal activities including property development, property investment, investment holding and leasing of lands. Daiman Development Berhad's (hereafter called "DAIMAN") principal activities including property development, property investment, sale of building materials, operation of golf, sports and recreation clubs, operation of bowling centre, nursery operation and investment holding.

Side-by-side Comparison

Capitalization

Measure by size, UMLAND is slightly larger than DAIMAN, 476 millions and 389 millions

Income Items

Important items under this section is per share earnings and dividend, DAIMAN is the all-time winner for both per share earning and dividend except averaged earned per share in 2009 to 2011 period.

Balance Sheet Items

DAIMAN have very solid balance sheet compared to UMLAND, Cash or cash equivalents almost can cover the Total liabilities, it is a cash-rich company which liquidity per share is 0.46.

Ratios

By look at Price ratios, DAIMAN is more attractive at the moment given it sell at lower multiple of 2011's earnings and much lower Price/book value per share, even UMLAND achieved slightly higher dividend yield.

DAIMAN advantages are much higher profit margin, almost double of UMLAND as shown by Net income/sales, but lower return on book value measured by Earnings/book value per share, which may due to the adoption of higher leverages by UMLAND.

UMLAND has much better earning growth rate compared to DAIMAN, please take note that DAIMAN achieved negative earning growth in 2009-2011 compared to 2005-2007.

Price Record

UMLAND and DAIMAN has comparable growth rate in near-term price record, but UMLAND achieved better growth in long-term, which may due to it's price start from a low base.

|

| UMLAND's Financial Summary |

|

| DAIMAN's Financial Summary |

As conclusion, the ultimate winner of this comparison is DAIMAN.

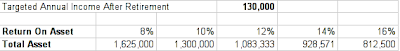

How Much DAIMAN Worth?

Given the company CAGR of EPS is 6% (approximately 6.7% in the past 5 years) and Dividend Per Share is 5% in the next 10 years, the EPS of the company will be RM$0.235 in 2020 (included adjustment of 2 bad years in 10 which reduce 30% of group's net profit) and the forecast dividends received over the 10 years period totaling RM$0.64 (included adjustment of 2 bad years).

If the stock price of DAIMAN sell at 8 times earning in 2021, it is RM$1.88 and RM$2.53 (included total dividends received) per share. Given annual 6% inflation rate in next 10 years, the discounted rate is 0.591898. So, RM$2.53 discounted to today price, it is RM$1.50 per share.

The discounted price is 23.7% lower comparing to today (30 March 2012) closing price at RM$1.85. The stock is overvalued! What do you think?

I'd love to hear comments from you!